Seamless, Turn-Key

Financing Solutions

Connecting lenders to new customers with innovative lending solutions.

Applicant Verification & Fraud Mitigation

Leveraging an array of tools to detect and prevent fraud at application.

Systematic Underwriting

Configurable and customizable per your product and risk appetites.

Consumer Portal

Self-service portal for customers to make payments, request advances, and review transaction and account records.

The BridgeFi program management solution supports consumer lending and merchant cash advance products:

- Lender-defined risk strategies

- Financial, compliance, and reputational risk mitigation

- Suite of Managed Services to support Lender needs

With the momentum of ~$2Bn funds distributed since 2019 and the scrutiny of multiple State and Federal examinations, BridgeFi stands ready to manage the entire process under lender-approved procedural protocols.

One Solution

BridgeFi Lending & Business Programs

Offers a suite of product options

Line of Credit

Provides for occasional, unexpected expenses

Installment Loan

Features monthly amortizing payments

Micro Loans

To help in a pinch

Merchant Cash Advances

To help small businesses grow

Meets Consumer Needs

Provides manageable payments over a short horizon

Interest rates from 36%-350% (loan products only)

Empowers consumers to graduate into more mainstream financial solutions with

- Credit Reporting

- Financial Literacy Tools

Supporting Lenders via

Managed Services

Marketing

Compliance

Loan-Buyer/Debt-Buyer File Management

Accounting & Treasury Services

Servicer Oversight

Our Traction

BridgeFi has demonstrated significant traction in terms of funds

distributed and geographic reach.

+$2B

Funds Distributed

+3.36M

Draws Funded

<7%

Default

+80%

Paid on Time

We’ve Done The Hard Part For You…

- Powerful, back-end identity verification and underwriting technology.

- Multi-Channel Application and Origination

- Multiple Lending Solutions

- Immediate Funding

- Lending Platform

- Cloud Based

- Scalable

- Proven

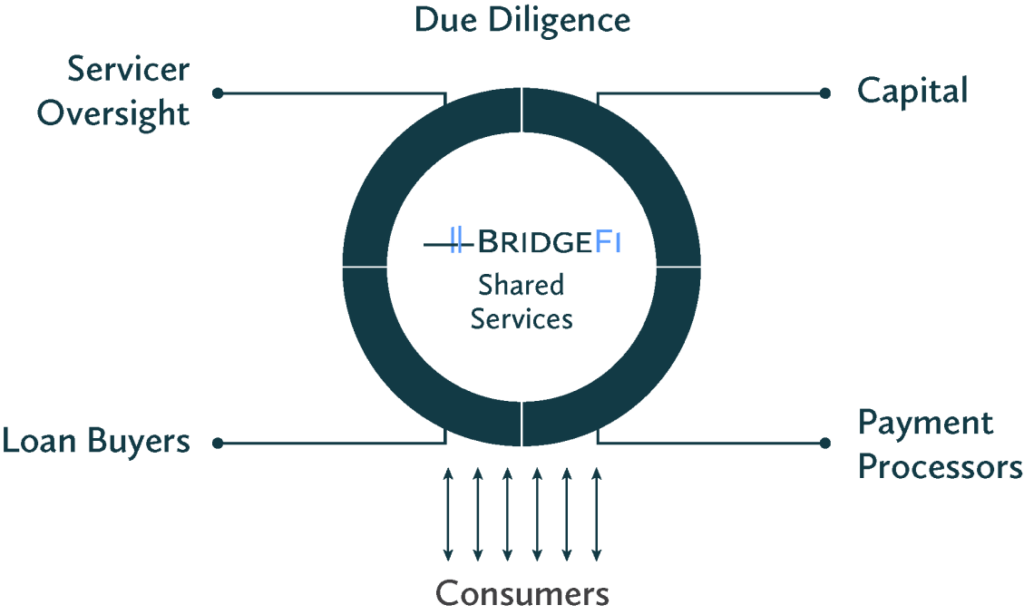

Stakeholder Example

Separation of roles eliminates

“Rent-a-Charter” and “True Lender” claims

Lender retains control of components central to the role of Lender – from underwriting and origination through funding and servicing

Lender designates BridgeFi to manage and integrate all required service providers to enable the lending program

Innovating Product

Distribution and Service

Led by a team with over 100 years of combined lending, compliance, technology, and risk experience.

Let’s Connect!

Once you have submitted your information, we will reach out to you to schedule a demo and talk more about your business needs.